Inflation is now falling, but what next for interest rates?

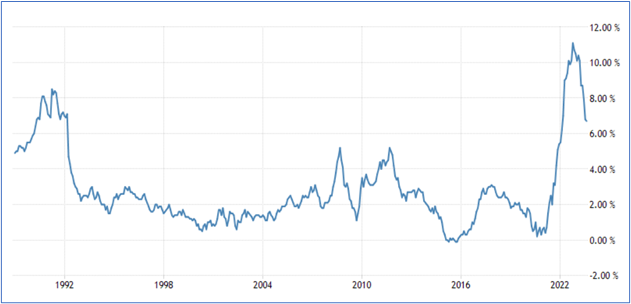

The economic landscape, once fairly consistent, has been reshaped dramatically in recent times. For nearly three decades, from 1992, the UK inflation rate comfortably resided below 6%. Indeed, for much of that period, it was around 2% – the Bank of England’s (BoE) mandated target rate.

However, as you can see from the chart below, there was a dramatic increase from a low point of 0.7% in March 2021, to a peak of 11.1% in October 2022, the highest inflation rate in over four decades.

Understanding the surge

This unprecedented spike stemmed from an amalgamation of multiple factors:

- The rush of demand surpassing supply after Covid

- The Russian invasion of Ukraine forcing up energy prices

- Volatile weather patterns causing a shortage in farm produce.

All this means that inflation and, as a result interest rates, went from an afterthought in news bulletins to the number one economic story, impacting the lives of individuals and businesses.

Since then, it has gradually fallen back to reach 6.7% in August. The latest Bank of England forecast is that inflation will fall to 5% by the end of 2023.

Source: Trading Economics

The Bank of England’s response

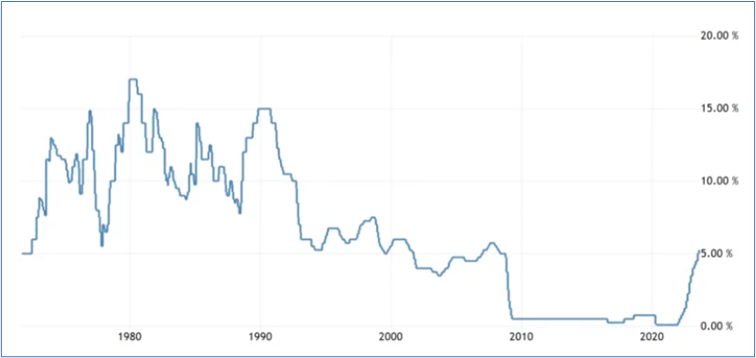

With inflation rising so quickly above their mandated target of 2%, the BoE took action to bring it under control.

The action taken was to raise interest rates to reduce demand and encourage people to save rather than spend, and an attempt to regain control over the escalating inflation.

Source: Trading Economics

The chart shows how quickly rates have risen from virtually zero to their current rate of 5.25% (as at September 2023). It means they are now at their highest level since 2009.

As a result, both individuals and businesses have seen borrowing cost increase dramatically over a short period of time.

The future outlook

While there’s optimism with inflation edging down to 6.7% in August, certain sectors, particularly food, still grapple with high inflation rates. Indeed, the Office for National Statistics reported an August food inflation rate of 13.6%, twice as high as the headline rate.

The governor of the BoE, Andrew Bailey, has warned that we should not expect interest rates to fall until there is “solid evidence” that inflation is slowing.

The BoE will want to be sure that a precipitous fall in interest rates won’t trigger a sudden spending surge and, as a result drive inflation back up. For this reason, it’s unlikely that the BoE will lower the base rate in the near future.

Interest rates are unlikely to revisit pre-2021 lows

It’s important to bear in mind that the unprecedented long period of low interest rates after the 2008 crisis were, in part, driven by quantitative easing (QE) as governments made cheap money available to boost economic activity.

It’s unlikely that we’ll see a repeat of that level of financial intervention going forward, which means that, while rates should eventually come down, they are unlikely to fall to the record low levels we saw previously.

Indeed, a report in the Times suggests it could take five years for rates to fall to 4%.

In effect, higher rates could well become “baked in” to the UK economy, and the new normal may well be a return to the period between 2000 and the financial crash when rates hovered around 5%.

Political pressure for rate reductions at the Bank of England

Many commentators have suggested that rates remaining at current levels in the long term is unsustainable – a fact that the BoE will be acutely aware of.

The impact on businesses has been severe, with high inflation resulting in pressure on wages at the same time as the increased cost of servicing debt resulting in potentially less spare capital being available for expansion and growth.

However, amidst these challenges, there are silver linings. The Bank says it expects inflation to drop significantly throughout the remainder of 2023, which could mark the end of rising rates. Indeed, a report in Moneyweek quotes several who predict that rates have likely reached their peak.

The future trajectory of interest rates will hinge on the pace at which inflation subsides.

Diverse industry impact

Clearly high interest rates can have a detrimental effect on businesses, regardless of their size. Increased borrowing often translates to reduced capital for business expansion and internal investments.

However, a report from Forbes suggests that there is an upside for businesses to rising interest rates. It points out the possibility of better returns on money held as working capital and improved cash flow, offering a potential silver lining amid the financial complexities.

Get in touch

If you’d like to talk to us about how high interest rates are affecting your clients, please get in touch with us.

We would be happy to discuss their needs and see if we can help.

To find out more, speak to the Business Development Manager in your local office.

Contact Our team today

Richard King

rking@ortussecuredfinance.co.uk

07388 993985

Chris Pallis

chris@ortussecuredfinance.co.uk

07867 266799

Jamie Russell

jamie@ortussecuredfinance.co.uk

07741 196308